Official Website of PhonePay :

What is PhonePay?

In today’s fast-paced digital world, managing your finances and making secure payments have become essential aspects of daily life. PhonePe, a leading digital payment platform, emerges as a versatile solution that offers an array of options for money management. From facilitating UPI transactions to providing wallet services, credit cards, insurance, and investments, PhonePe is a one-stop destination for all your financial needs. In this article, we will delve into the world of PhonePe, exploring its features and how it simplifies money management.

**Why Choose PhonePe?**

PhonePe stands out as a preferred choice for individuals and businesses for several compelling reasons:

1. **All-in-One Platform:** PhonePe offers a comprehensive suite of financial services, making it a single platform to manage various aspects of your finances.

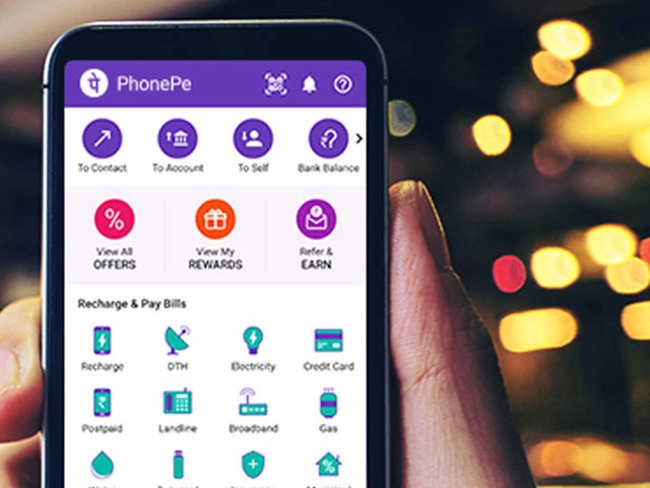

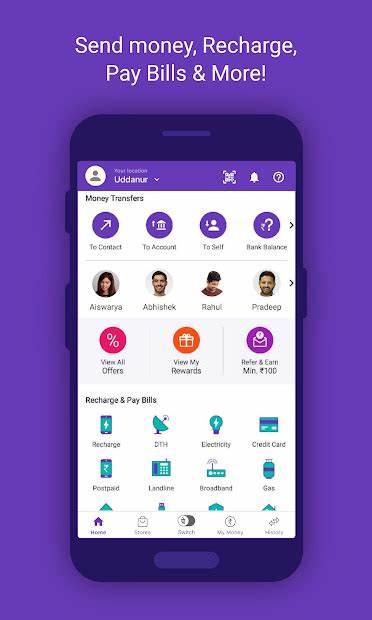

2. **Ease of Use:** The user-friendly interface of PhonePe ensures that even those new to digital payments can navigate and utilize its features with ease.

**Key Features of PhonePe**

Let’s explore some of the key features that make PhonePe a versatile financial management platform:

1. **UPI Transactions:** PhonePe allows users to make seamless UPI transactions, facilitating quick and secure fund transfers between bank accounts.

2. **Digital Wallet:** Users can store funds in their PhonePe digital wallet, simplifying online payments and eliminating the need to enter card details for every transaction.

3. **Credit Cards:** PhonePe offers credit cards that provide convenient payment options, rewards, and benefits for users.

4. **Insurance:** Users can purchase insurance policies through PhonePe, ensuring financial security and protection for themselves and their loved ones.

5. **Investments:** PhonePe provides investment options, allowing users to grow their wealth through various financial instruments.

**How PhonePe Works**

Understanding how PhonePe operates is crucial to harness its full potential:

1. **Registration:** Users need to download the PhonePe app and register with their mobile number. They can link their bank accounts to the app for seamless transactions.

2. **UPI Transactions:** Users can use PhonePe to send money, pay bills, make recharges, and shop online by selecting the UPI payment option and authorizing the transaction.

3. **Digital Wallet:** Funds can be added to the PhonePe wallet from linked bank accounts. This wallet can then be used for quick and secure payments.

4. **Credit Cards:** PhonePe provides users with the option to apply for and use credit cards. These cards offer various features and benefits, enhancing financial flexibility.

5. **Insurance and Investments:** Users can explore and purchase insurance policies or invest in mutual funds and other financial instruments directly through the app.

**Real-Time Scenarios and Examples**

Consider this real-time scenario to understand how PhonePe benefits users:

Imagine you’re a busy professional who frequently needs to make payments, both online and offline. You download the PhonePe app and link your bank account. Now, when you dine at a restaurant, you can simply scan the QR code and pay your bill using the UPI option on PhonePe, making the transaction quick and secure.

Additionally, you decide to apply for a PhonePe credit card, which offers attractive rewards and cashback on your everyday expenses. This card not only simplifies your payments but also helps you save money on your purchases.

As part of your financial planning, you explore the insurance options on PhonePe and purchase a policy that provides financial security for your family in case of unforeseen events.

Furthermore, you decide to diversify your investments and explore mutual funds through PhonePe’s investment platform. This allows you to grow your wealth while managing your finances in one place.

In conclusion, PhonePe emerges as a versatile digital payment platform that simplifies money management for users. Its comprehensive suite of financial services, including UPI transactions, digital wallets, credit cards, insurance, and investments, offers a one-stop solution for all your financial needs.

Why should we use PhonePay ?

With PhonePe, users can enjoy the convenience of quick and secure payments, while also exploring options for financial growth and protection. If you’re seeking an all-in-one platform to streamline your financial management and payment processes, PhonePe is the ideal choice. Unlock the potential of PhonePe and experience a seamless and efficient approach to managing your finances in the digital age.

Official Website link of PhonePay

Here is the link of this tool: PhonePay

Note: This link is a affiliate link. I would get some commission if you would purchase from this link. You won't be charged extra through. There are chances that you would get additional features if you would use this link as compared to purchasing directly 😉

Try out PhonePay and let me know your feedback in the comment section below:

- Unveiling the Wisdom of Isha Upanishad: Exploring the 18 Slokas - October 22, 2023

- Make Money Online: Your Path - September 27, 2023

- Launch Your Online Dream - September 27, 2023