Official Website of Google Pay :

What is Google Pay?

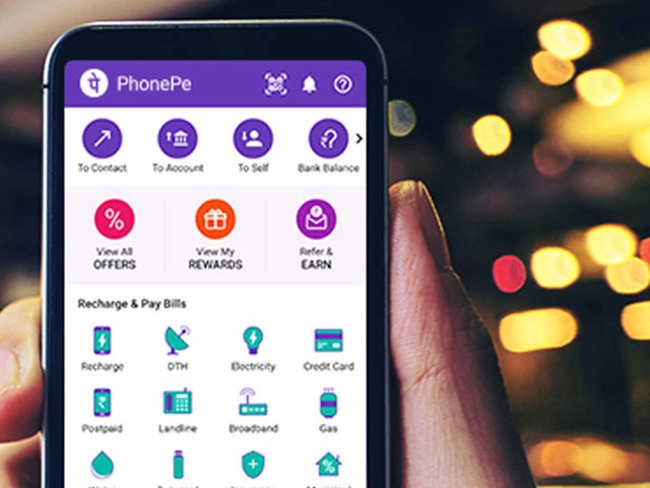

In a world where digital transactions have become the norm, Google Pay emerges as a formidable player, providing a seamless mobile payment service for users. Developed by tech giant Google, this platform empowers individuals to make payments with ease, whether it’s for in-app purchases, online shopping, or in-person contactless transactions. This article explores who should consider using Google Pay, why it’s advantageous, and the pros and cons of adopting this innovative payment solution.

**Who Should Use Google Pay?**

Google Pay is designed to cater to a wide range of users who seek the convenience of digital payments. Here’s who should consider using Google Pay:

1. **Android Device Users**: Google Pay is primarily tailored for Android users. If you own an Android smartphone or tablet, this payment service seamlessly integrates with your device.

2. **Online Shoppers**: Individuals who frequently engage in online shopping can benefit from Google Pay’s one-click payment option, making the checkout process faster and more secure.

3. **In-App Shoppers**: If you use mobile apps for various services, such as ride-sharing, food delivery, or entertainment streaming, Google Pay simplifies in-app payments.

4. **Contactless Payment Enthusiasts**: In the era of contactless payments, Google Pay allows users to make secure transactions at physical stores by simply tapping their smartphones.

5. **Security-Conscious Users**: Google Pay prioritizes security, offering advanced encryption and authentication measures, making it a choice for those concerned about the safety of their financial transactions.

**Why Choose Google Pay?**

Google Pay offers a plethora of advantages that make it an appealing choice for digital payments:

1. **Versatile Payment Options**: Google Pay covers a wide range of payment scenarios, from online shopping to in-app purchases and contactless payments, offering a comprehensive solution for users.

2. **Speed and Convenience**: With Google Pay, users can complete transactions swiftly, reducing the time spent at checkout counters or during online purchases.

3. **Security**: Google Pay employs multiple layers of security, including tokenization and biometric authentication, ensuring that your payment information remains safe from prying eyes.

4. **Integration**: The seamless integration with Android devices means that users can access Google Pay without the need for additional apps or hardware.

5. **Rewards and Cashback**: Many users enjoy cashback offers and rewards when using Google Pay for transactions, adding an incentive to continue using the service.

**Advantages and Disadvantages of Google Pay**

To make an informed decision, it’s essential to consider both the advantages and potential limitations of using Google Pay:

*Advantages:*

– **Versatility**: Google Pay covers a wide spectrum of payment scenarios, making it a versatile and all-encompassing payment solution.

– **Security**: The platform places a strong emphasis on security, employing encryption and authentication measures to protect users’ financial data.

– **Convenience**: Google Pay streamlines the payment process, reducing the need to enter card details repeatedly and saving time for users.

– **Integration**: Being integrated into Android devices ensures that Google Pay is readily accessible for millions of users.

– **Rewards and Incentives**: Users often enjoy cashback offers, rewards, and discounts when using Google Pay for transactions.

*Disadvantages:*

– **Limited iOS Support**: Google Pay is primarily designed for Android users, which means iOS users have limited access to its features.

– **Merchant Acceptance**: While widely accepted, some smaller or local businesses may not support Google Pay, limiting its usability in certain situations.

– **Internet Dependency**: As a digital payment service, Google Pay relies on an internet connection, which can be a drawback in areas with poor connectivity.

In conclusion, Google Pay stands as a robust and secure mobile payment service that caters to a broad spectrum of users. Its versatility, security features, and integration with Android devices make it a compelling choice for those seeking convenience and efficiency in their digital transactions. While there are some limitations, especially for iOS users and in certain merchant scenarios, the benefits of using Google Pay outweigh the potential drawbacks. Join the digital payment revolution with Google Pay today.

Why should we use Google Pay ?

Google Pay offers a versatile and secure mobile payment solution for Android users, allowing them to make in-app, online, and contactless payments with ease. Its emphasis on security, convenience, and integration sets it apart as a preferred choice for those embracing the digital payment era. Experience the future of payments with Google Pay.

Official Website link of Google Pay

Here is the link of this tool: Google Pay

Note: This link is a affiliate link. I would get some commission if you would purchase from this link. You won't be charged extra through. There are chances that you would get additional features if you would use this link as compared to purchasing directly 😉

Try out Google Pay and let me know your feedback in the comment section below:

- Unveiling the Wisdom of Isha Upanishad: Exploring the 18 Slokas - October 22, 2023

- Make Money Online: Your Path - September 27, 2023

- Launch Your Online Dream - September 27, 2023