Official Website of Paytm :

What is Paytm?

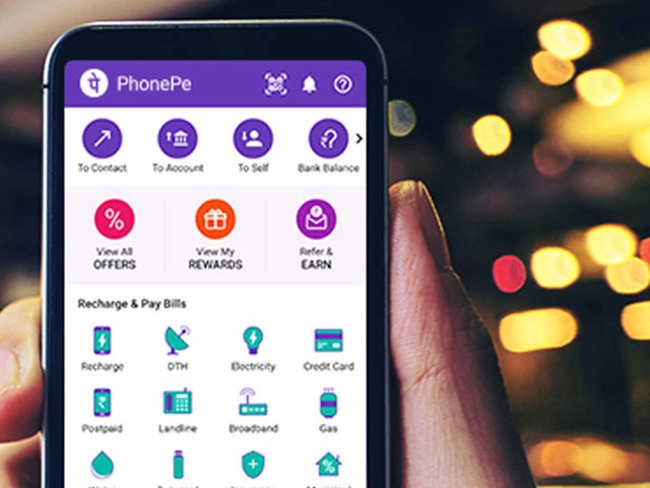

In the realm of banking, trust and convenience are paramount, and Paytm Payments Bank stands as a beacon of sincerity in India’s financial landscape. Offering secure, transparent, and risk-free banking services, Paytm Payments Bank puts the power of hassle-free banking right at your fingertips. From instant account opening to a virtual debit card, Paytm provides a platform that ensures easy bill payments, helping you avoid additional late fees. This article will delve into why Paytm Payments Bank is a reliable choice, who can benefit from its services, and the advantages it brings to the table for its customers.

**Who Should Choose Paytm Payments Bank?**

Paytm Payments Bank caters to a wide array of individuals who seek a reliable and efficient banking experience. Here’s who should consider choosing Paytm Payments Bank:

1. **Digital-Savvy Consumers**: Individuals who prefer the convenience and efficiency of digital banking will find Paytm Payments Bank to be a seamless fit.

2. **Bill-Payment Seekers**: Those looking for a platform that simplifies bill payments, ensuring they are made on time and avoiding late fees, will benefit from Paytm’s services.

3. **Mobile Recharge Enthusiasts**: If you frequently recharge your mobile phone, Paytm provides a one-stop platform with the best offers and plans from major operators like Jio, Airtel, BSNL, Vi, and more.

4. **Virtual Card Users**: Individuals who value the security and convenience of virtual debit cards will appreciate the offering from Paytm Payments Bank.

5. **Cashback Enthusiasts**: For those who enjoy cashback benefits, Paytm’s loyalty cashback program provides an attractive incentive to use their services for payments.

**Why Opt for Paytm Payments Bank?**

Paytm Payments Bank provides a range of compelling advantages that make it a standout choice for modern banking:

1. **Instant Account Opening**: With Paytm, you can open an account swiftly, eliminating the lengthy process associated with traditional banks.

2. **Virtual Debit Card**: The provision of a virtual debit card offers a secure and convenient payment method for online transactions.

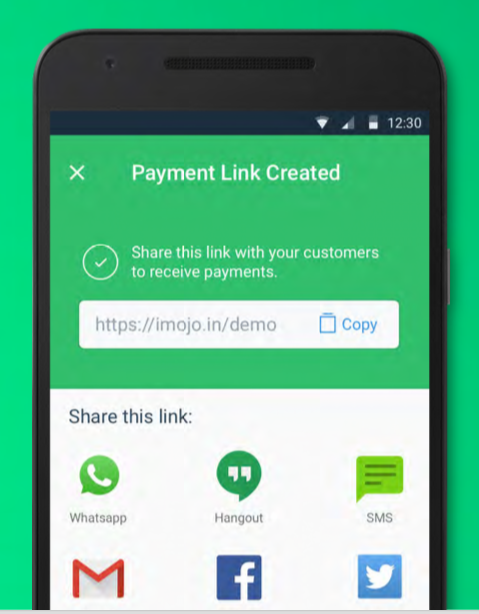

3. **Hassle-Free Bill Payments**: Paytm simplifies bill payments, ensuring they are made on time and helping users avoid additional late fees.

4. **Best Recharge Offers**: The platform offers a curated selection of the best recharge offers and plans from major mobile operators, providing cost-effective options for users.

5. **Cashback Rewards**: Paytm’s loyalty cashback program provides users with cashback benefits that can be used to pay for goods and services offered by merchants who accept ‘Pay with Paytm’ payments.

**Advantages and Considerations**

To make an informed choice, it’s essential to weigh the advantages and potential considerations of using Paytm Payments Bank:

*Advantages:*

– **Convenience**: Paytm offers a user-friendly and convenient platform for digital banking, allowing users to manage their finances effortlessly.

– **Time Efficiency**: The instant account opening feature and seamless bill payments save users valuable time in their banking activities.

– **Security**: The provision of a virtual debit card enhances security for online transactions, offering peace of mind for users.

– **Cost-Efficiency**: Users can take advantage of the best recharge offers and plans, ensuring they get the most value from their mobile services.

– **Cashback Benefits**: The loyalty cashback program provides users with an attractive incentive for using Paytm’s services.

*Considerations:*

– **Merchant Acceptance**: While widely accepted, users should be aware that not all merchants may support ‘Pay with Paytm’ payments.

– **Internet Dependency**: As a digital platform, Paytm relies on a stable internet connection, which may be limiting in areas with poor connectivity.

– **Virtual Card Limitations**: While virtual debit cards offer enhanced security, they may not be suitable for all types of transactions.

In conclusion, Paytm Payments Bank emerges as a trustworthy and convenient banking solution, offering a range of services that cater to modern consumers’ needs. Its instant account opening, virtual debit card, and seamless bill payment features simplify financial management. The platform’s cashback benefits add an attractive incentive for users. While considerations regarding merchant acceptance and internet dependency exist, the advantages of using Paytm Payments Bank far outweigh these potential limitations. Embrace the future of banking with Paytm Payments Bank and experience secure and hassle-free financial management at your fingertips.

and

Why should we use Paytm ?

Paytm Payments Bank offers a secure, transparent, and convenient banking experience, with features like instant account opening, virtual debit cards, and hassle-free bill payments. The platform also provides the best recharge offers for major operators, along with cashback rewards for users. Embrace the efficiency and simplicity of modern banking with Paytm Payments Bank.

Official Website link of Paytm

Here is the link of this tool: Paytm

Note: This link is a affiliate link. I would get some commission if you would purchase from this link. You won't be charged extra through. There are chances that you would get additional features if you would use this link as compared to purchasing directly 😉

Try out Paytm and let me know your feedback in the comment section below:

- Blog 4 - September 3, 2024

- Unveiling the Wisdom of Isha Upanishad: Exploring the 18 Slokas - October 22, 2023

- Make Money Online: Your Path - September 27, 2023

Skip to content

Skip to content